net investment income tax 2021 proposal

B the excess if any of. This proposal would be effective for tax years beginning after Dec.

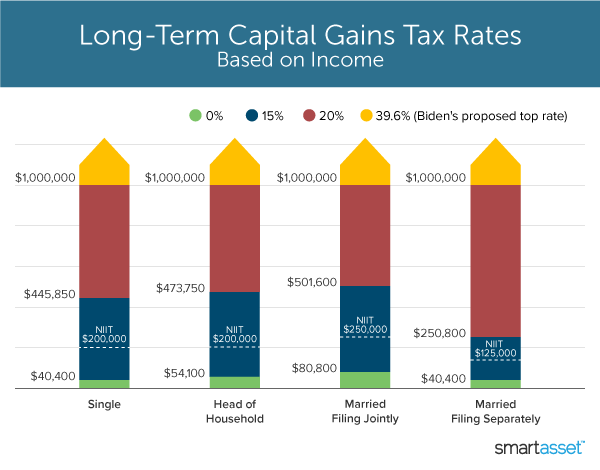

What S In Biden S Capital Gains Tax Plan Smartasset

The amount subject to the tax is the lesser of your net investment income or the amount by which your MAGI exceeds the threshold 250000 200000 or 125000 that.

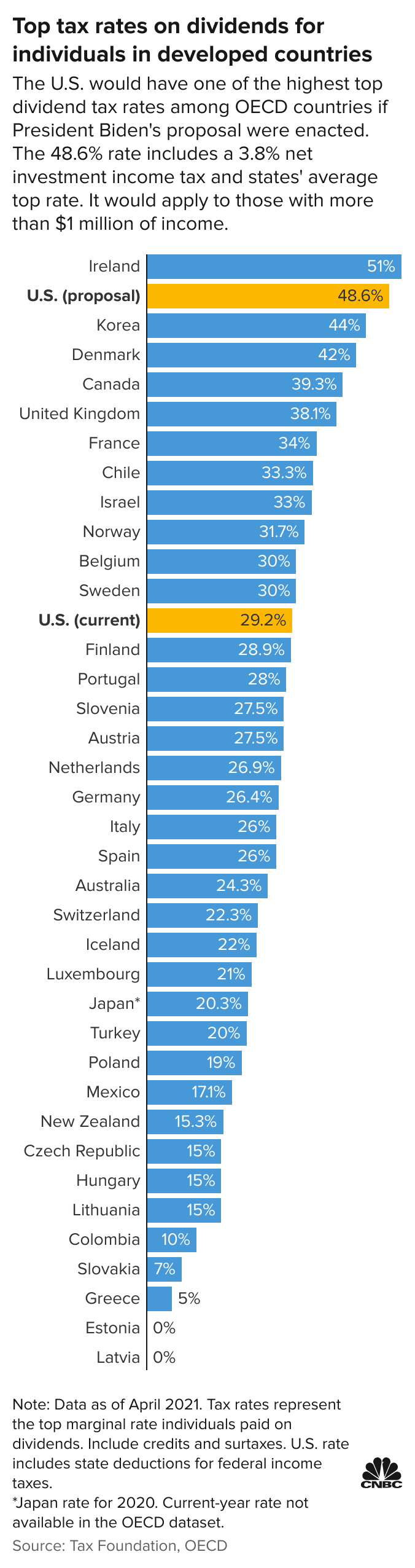

. At first blush the proposal. The top federal rate on capital gains would be 434 percent under Bidens tax plan when including the net. An increase in the top individual tax rate from 37 to 396 for tax years ending after Dec.

Nearly all of the changes we saw in the September 13th tax proposal are gone. Tracking the 2021 Biden Tax Plan and Federal Tax Proposals. An additional 3 tax will be imposed on a taxpayers modified adjusted.

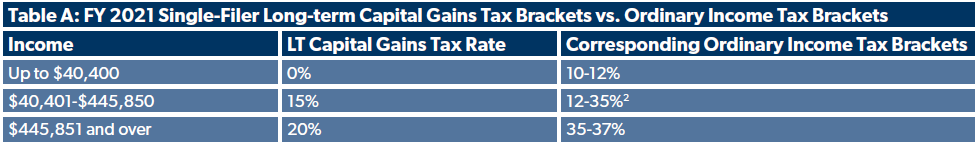

The adjusted gross income over the dollar amount at which the highest tax bracket begins for an estate or trust for the tax. Expanding the net investment income tax. Increase in the maximum long-term capital gains rate The maximum capital gains rate would increase to.

If the amount on your 2021 Federal Form 10401040-SR1040NR line 18 is zero and the Net Investment Income Tax from line 17 202 1 Form 8960 is also zero STOP enter zero on. This change would be effective as of September 13. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

A the undistributed net investment income or. Expands the 38 net investment income tax for taxpayers earning over 500000 married filing jointly. The proposal would increase the capital gains tax rate for individuals earning 400000 or more to 25 from 20.

For 2021 the government will raise 275 billion in revenue generated from net investment income tax alone according an analysis by the Congressional Research Service. A special transition rule provides that the proposed maximum tax rate of 25 percent would only apply to qualified dividends and long-term capital gains realized after. We can forget about.

The top capital gains tax rate remains 20 versus an increase to 25. For income tax purposes T can reduce his taxable income by the FEIE amount for tax year 2021 the FEIE is US108700 meaning only US100000 will be subject to income tax. Fortunately there are some steps you may be able.

These individuals are also exempt from the 38 Medicare or net investment income tax NIIT which currently applies only to certain passive income and gains. Limiting the Section 199A deduction for qualified business income. High-income taxpayers face a 38 net investment income tax NIIT thats imposed in addition to regular income tax.

Net Investment Income Tax NIIT presents a big planning opportunity. In the case of an estate or trust the NIIT is 38 percent on the lesser of. D-OR in the Small Business Tax Fairness Act introduced in July 2021.

Ensure that all pass-through business income of high-income taxpayers is subject to either the net investment income tax NIIT or SECA tax.

Here S How Biden S Build Back Better Framework Would Tax The Rich

House Democrats Tax On Corporate Income Third Highest In Oecd

Tax Facts On Individuals 127th Edition Ebook In 2021 Business Ebook Health Insurance Humor Small Business Accounting

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Free Editable Startup Funding Proposal Template Word Template Net Startup Funding Proposal Templates Up Proposal

What Is The The Net Investment Income Tax Niit Forbes Advisor

Seven Federal Tax Areas Businesses Should Be Focusing On During Year End Planning

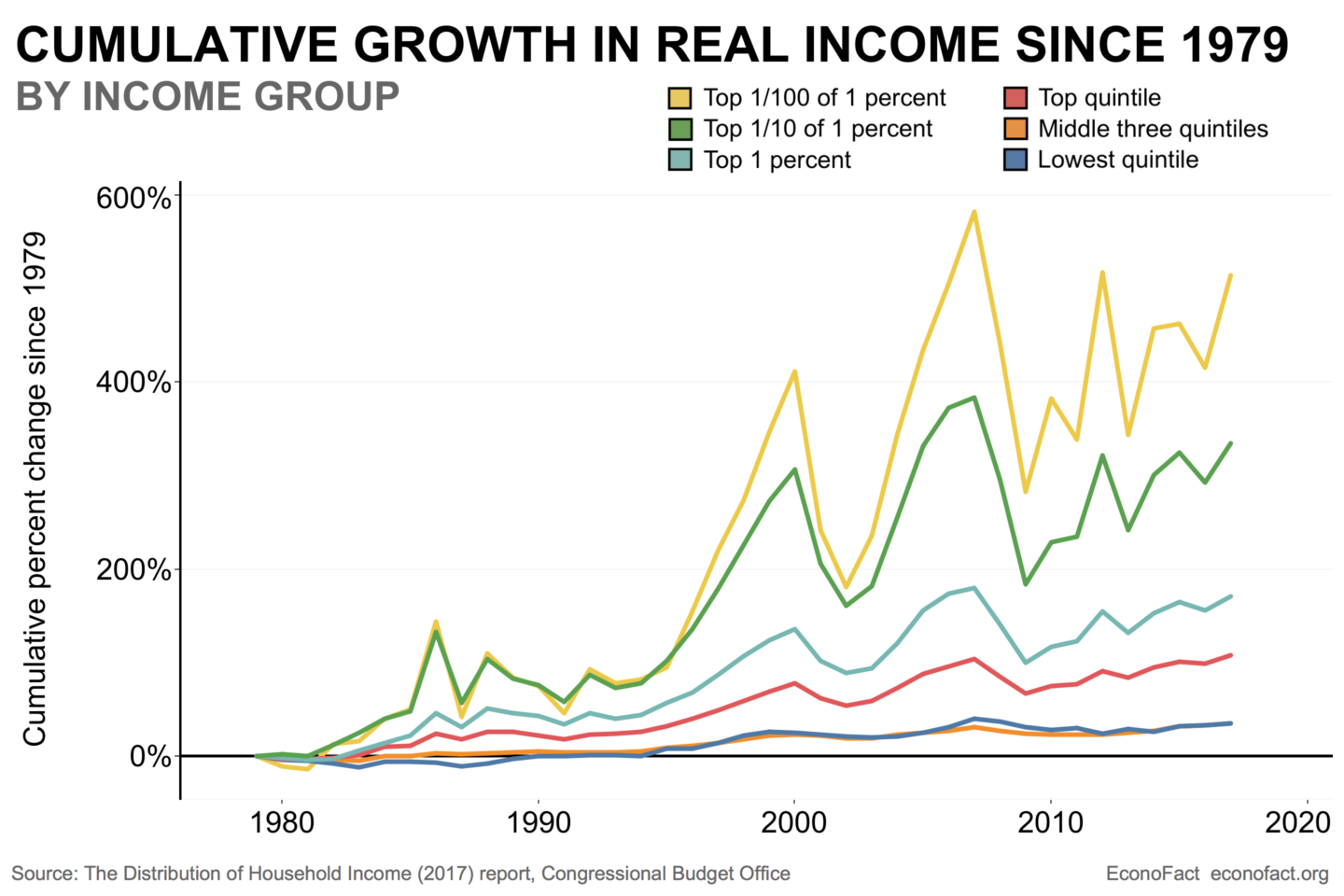

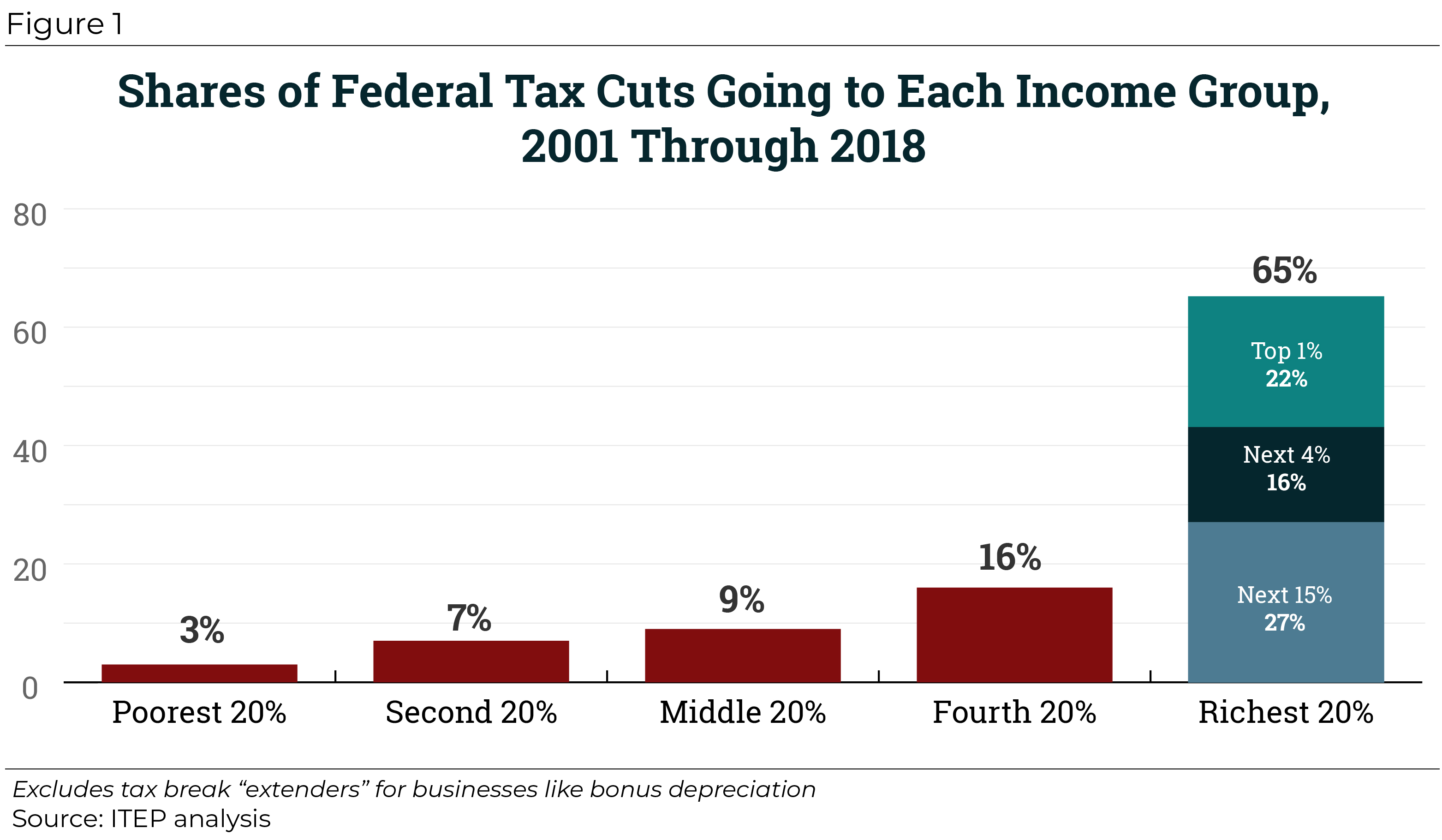

Federal Tax Cuts In The Bush Obama And Trump Years Itep

Billionaires Tax On Capital Gains Invites Tax Collection Volatility

Summary Of Fy 2022 Tax Proposals By The Biden Administration

A Closer Look At 2021 Proposed Tax Changes Charlotte Business Journal

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

What S The Deal With Capital Gains Taxes Foundation National Taxpayers Union

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

Like Kind Exchanges Of Real Property Journal Of Accountancy

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation